Variances are often found difficult by AAT students. Here’s an analogy that may help you to understand them better.

Eggsamine business decisions with variances:

When my second son was very young we discovered that he was intolerant to gluten. As a family we enjoy baking and cakes, although not necessarily in that order. To accommodate our second son we needed to change to using gluten free flour. At first the bakes did not come out well. My performance as a baker had deteriorated with the introduction of this new material. Other people were successfully making gluten-free cakes so the gluten free flour could not be the only factor so I needed to work out what was the issue.

In the accounting world, we need to do the same:

Profit last month was not as expected and we need to diagnose what is the cause of the problem. Was it the introduction of a new material?

Suppose we expected a profit of £5,000 but achieved a profit of £3,000. What explains the £2,000 difference? The new material cost the business an extra £200 compared with the prior month. That explains part of the fall but not all of it.

Returning to my gluten free cake, I decided to bake it for longer. My oven is quite slow and I am used to baking/roasting things for 50% more than the recipe says. So I left the cake in the oven for even longer than I usually do. The cake came out worse.

Could the profit deterioration be caused in the production process as well as the change in materials? An investigation reveals that the new material means that the machines need less time to process the product. The better quality and more expensive material needed less processing which led to a £500 favourable variance.

Looking at the numbers, we now have:

- Budgeted profit – materials adverse variance + machine favourable variance – unknown variance = actual profit That is £5,000 – £200 + £500 – £2,300 = £3,000.More investigation is needed to find out what the £2,300 could be.

Perhaps my cake needed more mixing time. With no gluten in the flour, perhaps I needed to mix it for longer to try to encourage the mixture to stick together better. So I increased my labour time and muscle mass by mixing the ingredients for longer.

Back in the factory we discover that the new material was confusing for the employees. They were not used to it and while it took less time for the machines to process the product, it took more time for the employees to load the machine with the new material and they needed more time to prepare and more time to inspect after removing the product from the machine. The main cause for the fall in profit was the additional labour time.

- Budgeted profit – materials adverse variance + machine favourable variance – labour adverse variance = actual profit That is £5,000 – £200 + £500 – £2,300 = £3,000.The variance analysis has allowed us to understand what went wrong.

It is possible to drill down into these variances to find out if there was a particular component of material costs that caused the problem. In our example so far we examined materials, machine use and labour one step at a time to try to diagnose the problem and we’ll need to do the same when we drill down into any particular variance.

Let’s look at material variances. The cause of the adverse variance could be down to the cost of the materials or it could be down to the use of the materials. There could be other causes such as a change in mix of materials but let’s keep it as simple as possible in this blog and focus on cost/price and usage.

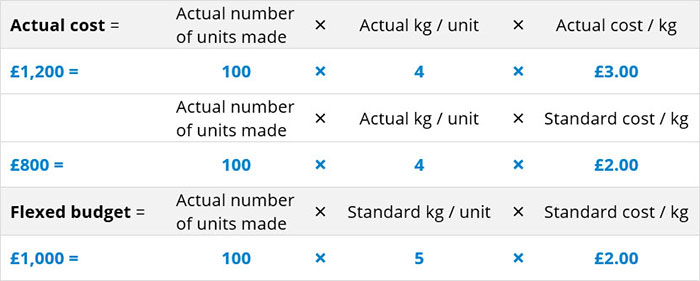

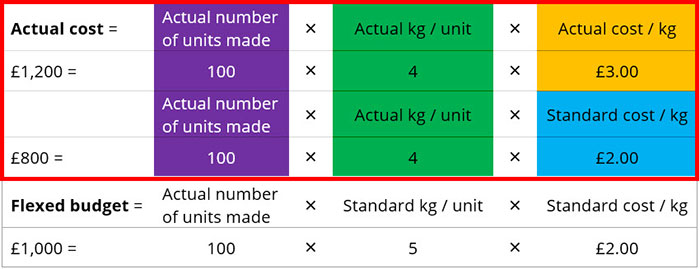

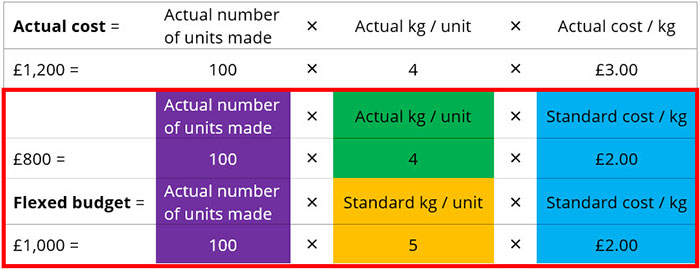

The first line of the table shows that the actual cost of making 100 units is £1,200. The bottom line shows the flexed budgeted cost of £1,000. Remember that we need to flex the budget to take into account that the volume of sales or production was different to the original budget. We need to drill into this £200 adverse variance. Was this caused by the cost of the material or the usage of the material.

Like we did earlier, we need to look at each of these separately. Now compare the first line with the middle line.

The 100 units stays the same (both shaded purple). The kg/unit stays the same (both shaded green). The only thing we change between the first and middle line is the cost per kg – the actual cost per kg was £3 and the standard cost was £2. Looking at the totals for these two lines we can see that the actual cost was £1,200 and the total of the middle line is £800. That means that the £1 difference in the cost per kg led to a total adverse materials price variance of £400.

Let’s consider the middle and bottom lines now.

The 100 units stays the same (both shaded purple). The cost per kg stays the same (both shaded blue). This time the only factor we are changing is the kg per unit. We planned to use 5kg/unit but we actually used 4kg/unit. Comparing the totals on the left of the table we can see that the overall effect of this was a £200 favourable materials usage variance.

Overall our actual materials cost was £1,200. The more expensive materials caused the cost to go up by £400 but this was mitigated by using less of the materials reducing the difference by £200. The overall effect was a £200 adverse variance.

Was it a good idea to buy the more expensive materials? We can assume that the plan was to reduce the consumption of the material by using a better quality version. Unfortunately the additional cost of the materials outweighed the savings from using less of them.

The variance has helped us to diagnose what went wrong in the process and helped us to assess the decision making.

We can do the same for labour variances too. We evaluate the variance by changing just one factor at a time: first the cost per hour and then the hours per unit to give us the labour rate variance and the labour efficiency variance respectively.

But what about the cake? How did I improve on the gluten free cake? I used an extra egg.