Do you confuse your margins and mark-ups?

People often get confused between margins and mark-ups and sometimes incorrectly use them interchangeably, we’re here to help!

This article aims to provide a clear explanation of the concept along with an example or two to give you an idea of what we mean.

The AAT also have a useful study-tip post all about margins and mark-ups, if you need some extra support: Study tips: Margins and mark-ups – AAT Comment

Example 1

You buy baked beans from your supplier for £0.50 per can.

You sell them for £1.00

Mark-up:

This is a mark-up of £0.50

This can also be expressed as a mark-up of 100% i.e. you have added a profit of £0.50 (100% of the original cost).

Margin:

Your profit of £0.50 is 50% of the sales price

This can be expressed as making a margin of 50%

Most retail and wholesale businesses will operate in this way and a shopkeeper will have a range of mark-ups depending on the types of goods that they are selling.

Luxury goods typically have a much bigger mark-up and quite often, the supplier will suggest a mark-up by showing on their invoice the recommended retail price, but then deducting a trade discount. The trader can simply add the trade discount back when pricing up the goods.

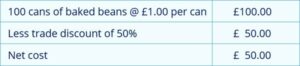

Example 2

A baked bean supplier might show on their invoice to the shop:

We express margin and mark-up in percentage terms.

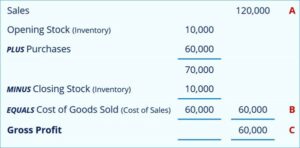

Let’s look at this in terms of the annual trading account:

(for ease, we’ll assume that opening stock and closing stock are the same)

Mark-up:

The Mark-up = C / B i.e., 60,000/60,000 x 100 = 100%

(We have marked up the cost of goods sold of £60,000 by 100% to arrive at our sales figure of £120,000)

Margin:

The Margin = C / A i.e., 60,000/120,000 x 100 = 50%

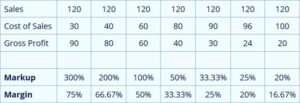

Here are a range of margins and mark-ups for you to see the inter-relationship between them – and to practice your algebra!!

Did you find this article valuable?

If you would like to know more about margins and mark-ups as well as other key topics then you might want to consider the AAT Level 3 Diploma in Accounting.

You can read more about it here: AAT Level 3 Accounting – Accountancy Learning

We hope that these study tips have helped you and have made the difference between your margin and mark-ups clearer! Please let us know if there are any further topics you would like us to write about.

If, however, you are one of our tutor-supported students, please get in touch with your personal tutor who will be more than happy to help you.

Ready to enrol? Click here: Shop – Accountancy Learning

For any other questions, please get in touch with us, we are always happy to help.

Call us: 01392 435349

Email us: [email protected]

Message us: Facebook