Accruals And Prepayments Example No. 2

As students often take a little while to get their heads round accruals and prepayments, we thought we would work through another example. So here it is:

Have you seen our Accruals and Prepayments BLOG Part 1? If not, then please view that one first – you can read it HERE:

ADVERTISING EXPENSES FOR YEARS ENDED 31.01.16 and 31.01.17

Step 1: During the year ended 31st January 2016, we paid £6,900 for advertising expenses invoiced to us. During February 2016 (i.e. after the year-end), we received an invoice for £1,325 that related to advertising undertaken in January.

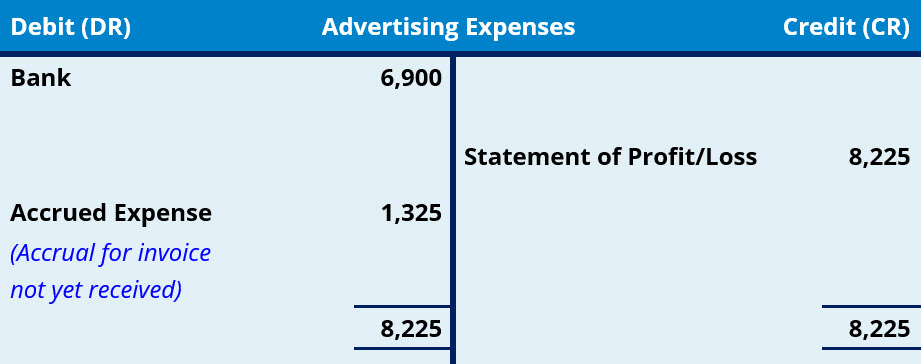

We have therefore accrued for this in the 2016 accounts. The two T accounts we will use are:

a) The Advertising Expenses Account (in the SPL / P&L A/C), and

b) The Accrued Expenses Account (SoFP / BS)

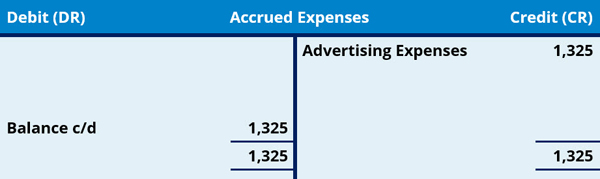

These are shown below. The Advertising Expenses Account shows the bank payment of £6,900 plus the accrued expense of £1,325, amounting to a total to be transferred to the SPL of £8,225. The Accrued Expenses Account shows the balance of £1,325 which will be included in Creditors in the SoFP (Statement of Financial Position)

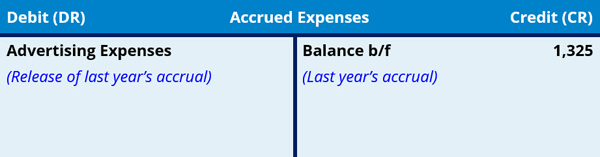

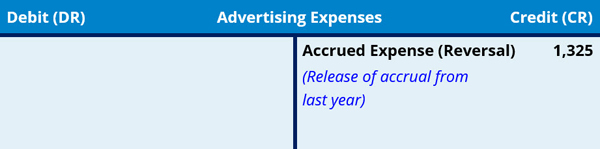

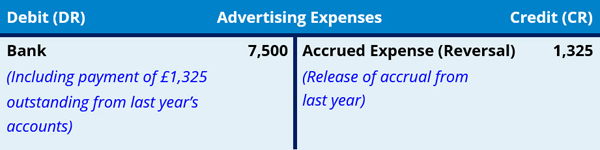

At the start of the year ended 31.01.17 (i.e. on 01.02.16), we reverse the accrued expense and transfer it back to the Advertising Expenses Account – as shown below.

This leaves a nil balance on the Accrued Expenses Account and a credit balance on the Advertising Expenses Account of £1,325

During the year to 31st January 2017 we paid £7,500 for advertising expenses, including paying the accrued invoice of £1,325 when it was received. The Advertising Account now looks like this.

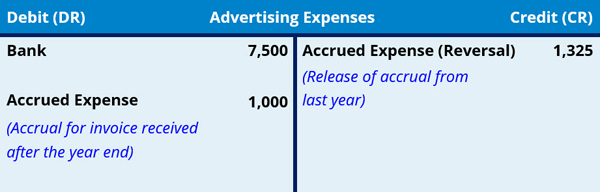

After the year end, an invoice of £1,500 was received. This relates to a 3 month advertising campaign in the local paper, covering December 2016, January 2017 and February 2017. Therefore 2/3rds of the £1,500 related to the year ended 31st January 2017 and will need to be accrued – i.e. £1,000

As with the previous year, we do this by debiting the expense account (we are increasing the expense to reflect the true cost in the year). The two Accounts will now look like this:

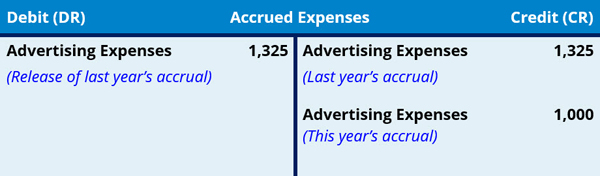

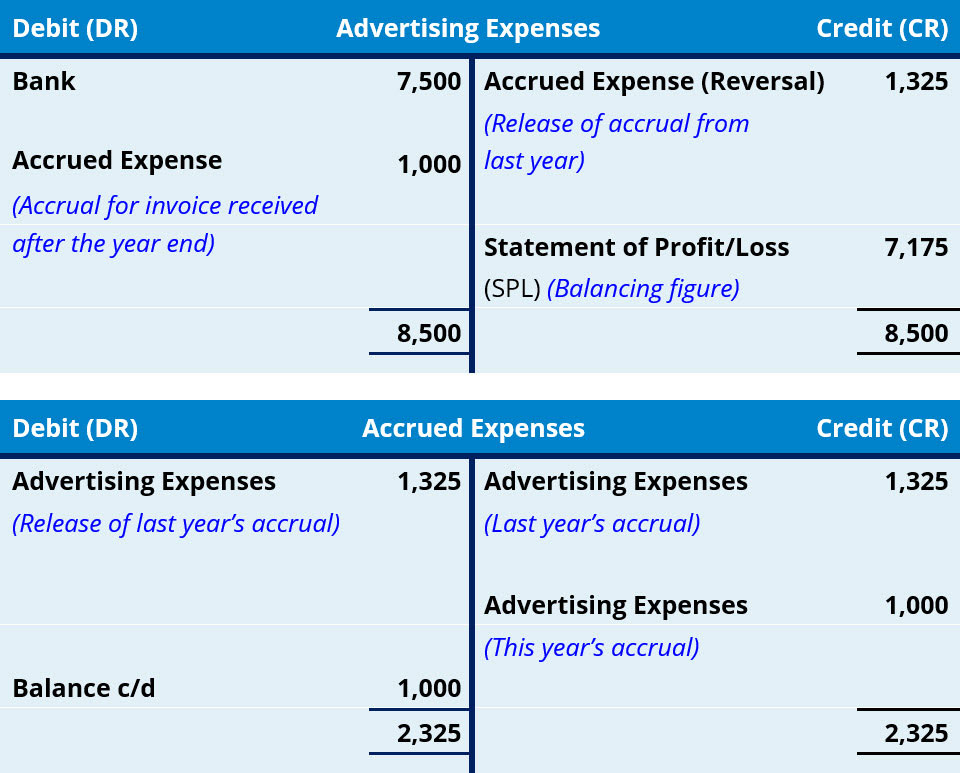

We now need to balance off both, transferring the balance on the Expenses Account to the SPL and carrying down the balance on the Accrued Expenses Account and including it in the SoFP (aka

Balance Sheet as it is a summary of the Balances……and the debits and credits should balance!)

The Accounts will now look like this:

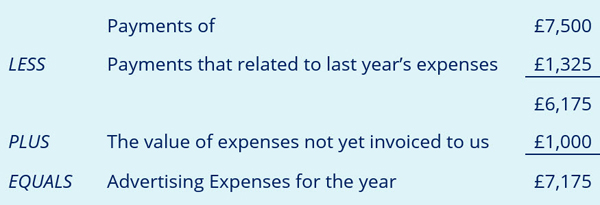

Looking at this in the form of an equation, the expense for the year is made up of:

Another way to look at this is to see how the SLCA and PLCA accounts work:

These accounts effectively work in the same way, in that they accrue for income not yet received, and for expenses not yet paid.

Re the SLCA, you create an invoice for a credit customer but you don’t get paid for the goods/services until 30 days later. You still record the sale (CR Sales account). However, as the invoice hasn’t been paid yet, you “accrue” the sale in the SLCA (DR SLCA) until it is paid – very similar to how the Accrued Income account works.

The PLCA account works in a similar way.

The principle is that the SPL (P&L A/C) should recognise the income earned and the expenses incurred during the year, irrespective of whether or not they have been invoiced or paid.

Happy studying!

If you found this BLOG valuable and would like to know more about Accruals and Prepayments (as well as other key topics), you might want to consider the AAT Advanced Diploma in Accounting (or the Advanced Certificate in Bookkeeping) – you can read more about this internationally recognised qualification HERE:

We hope that these study tips have helped you! Whilst we are not able to respond to any specific questions you might have about our posts, do please let us know if there are any further topics you would like us to write about. If, however, you are one of our tutor supported students, please get in touch with your personal tutor who will be more than happy to help you.